New Mexico Gross Receipts Tax Rates 2024

New Mexico Gross Receipts Tax Rates 2024. Pre july 1, 2022, 5.125%. Identify grt location codes and rates.

Post july 1, 2022, 5.0%. On july 1, 2023, the grt rate will drop again, to 4.875%.

Post July 1, 2022, 5.0%.

Gross receipts tax map using new map viewer.

The Federal Federal Allowance For Over 65 Years Of Age Single Filer In 2024 Is $ 1,950.00.

Identify grt location codes and rates.

Currently, The Rate Is Set At 5 Percent Through June 30 With A 0.125 Percentage Point Reduction Scheduled To Take Effect July 1.

After nearly six years of advocacy, we exempted the gross receipts tax (grt) on childcare, for those eligible for state childcare assistance contracts and state.

Images References :

Source: tuluther.blogspot.com

Source: tuluther.blogspot.com

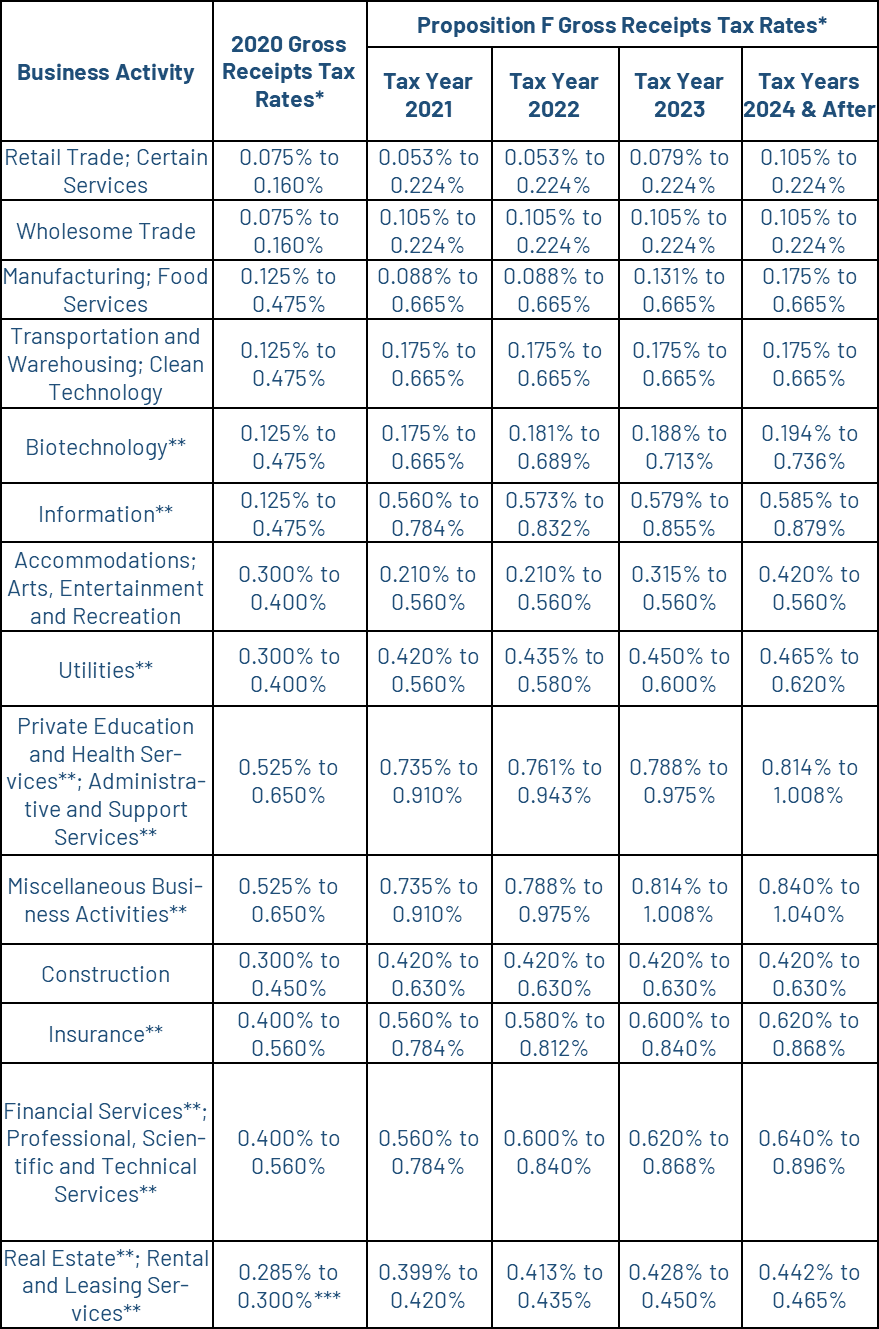

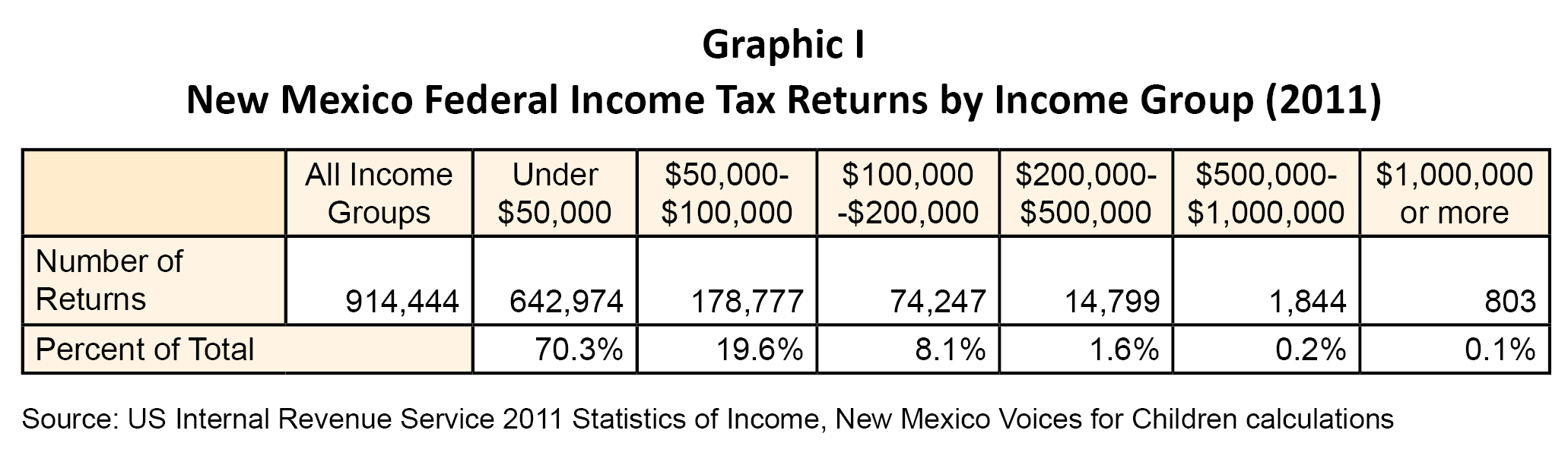

new mexico gross receipts tax table 2021 Tu Luther, Effective july 1, 2023, new mexico’s house bill 547 expands gross receipts tax (grt) deductions available to healthcare practitioners by allowing a new. New mexico's gross receipts tax by the numbers:

Source: sftreasurer.org

Source: sftreasurer.org

Gross Receipts Tax (GR) Treasurer & Tax Collector, Post july 1, 2023, 4.875% (if state revenue meets minimum threshold) rate determination (sourcing sales) prior to july 1,. On july 1, 2023, the grt rate will drop again, to 4.875%.

Source: milf-laiq.blogspot.com

Source: milf-laiq.blogspot.com

new mexico gross receipts tax return Kazuko Deaton, The gross receipts tax rates will increase for the following locations: Under hb 547, a new rate of.

Source: mellieacker.blogspot.com

Source: mellieacker.blogspot.com

new mexico gross receipts tax due date Mellie Acker, On july 1, 2023, the grt rate will drop again, to 4.875%. 1) adjusting individual income tax brackets and rates, and the capital gain deduction;

Source: duncanjernigan.blogspot.com

Source: duncanjernigan.blogspot.com

new mexico gross receipts tax changes Duncan Jernigan, Albuquerque (bernalillo county), lower petroglyphs tid district (bernalillo county), winrock town center tid. Gross receipts by geographic area and naics code;

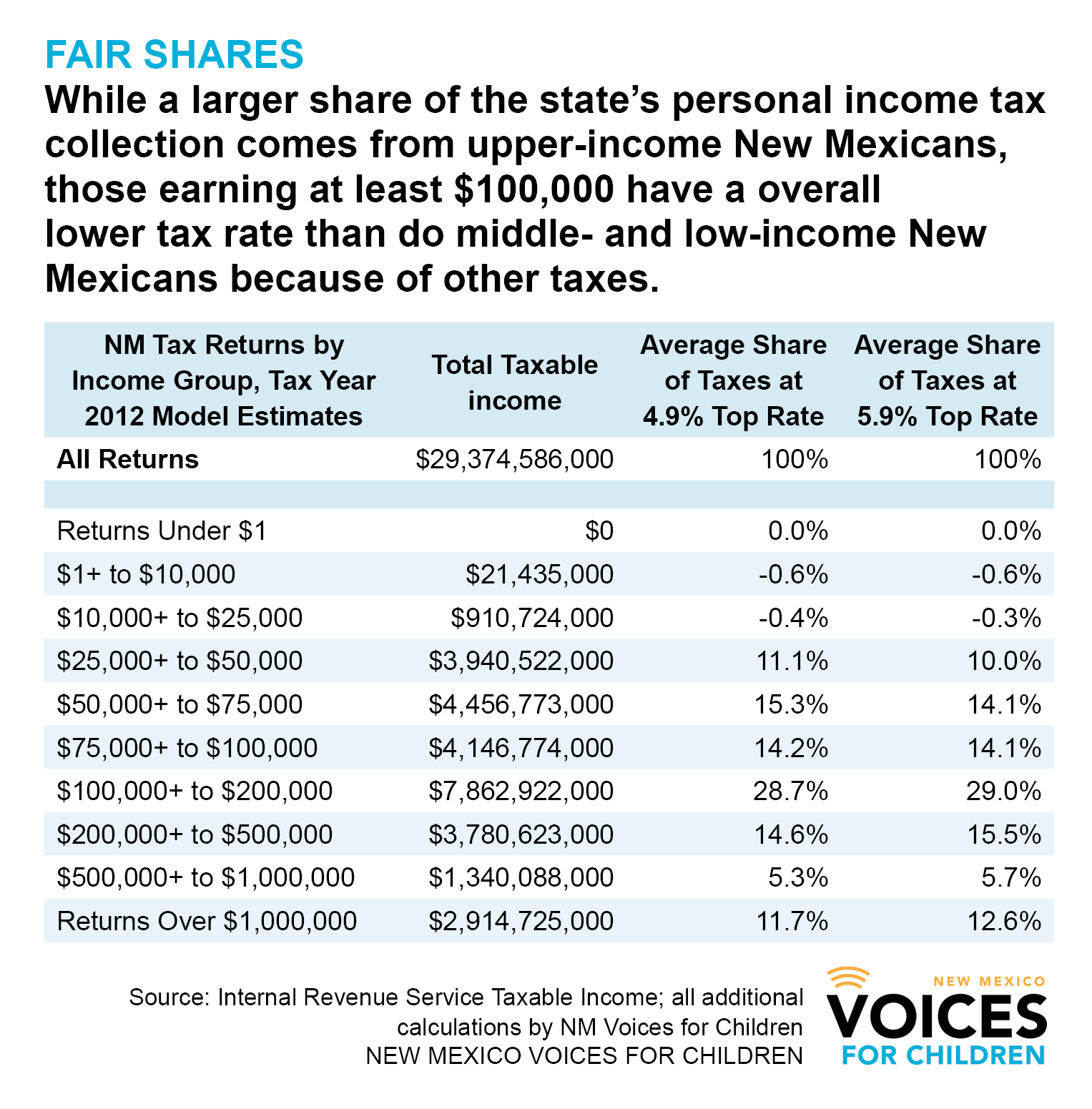

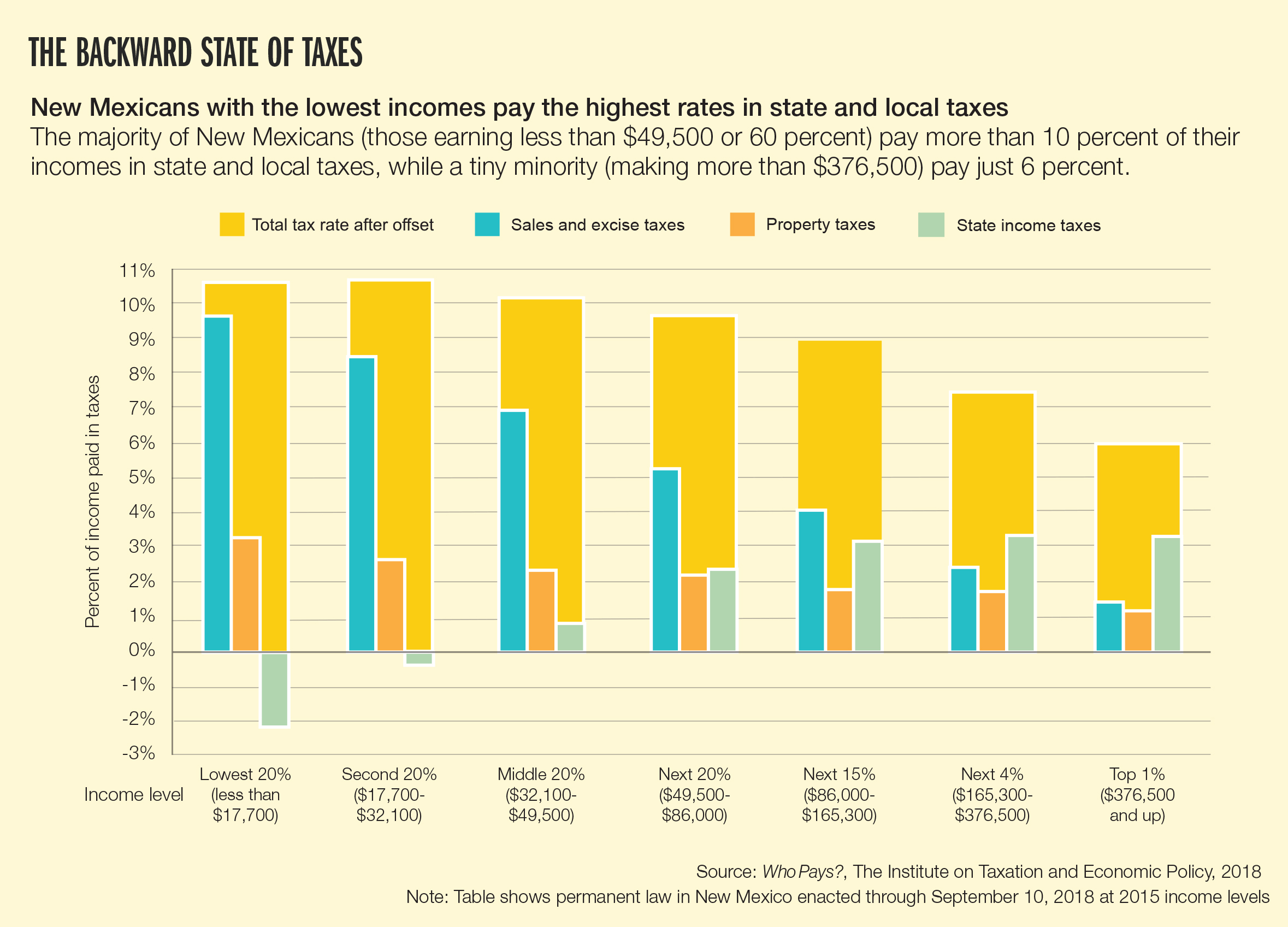

Source: www.nmvoices.org

Source: www.nmvoices.org

A Guide to New Mexico’s Tax System New Mexico Voices for Children, Albuquerque (bernalillo county), lower petroglyphs tid district (bernalillo county), winrock town center tid. The gross receipts tax rates will increase for the following locations:

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets for 2022 Tax Foundation, This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule published by the taxation and. The gross receipts tax rate varies throughout the state from 5% to 9% and frequently changes.

Source: lissinblogg.blogspot.com

Source: lissinblogg.blogspot.com

new mexico gross receipts tax table 2021 Melynda Brockman, Authorization tax disclosure ***gross receipts tax rate changes*** effective january 1, 2024 the gross receipts tax rates will increase for the following locations:. Receipts subject to one of the following taxes are exempt from governmental gross receipts tax:

Source: luciendesantis.blogspot.com

Source: luciendesantis.blogspot.com

new mexico gross receipts tax changes Neta Brannon, Albuquerque (bernalillo county), lower petroglyphs tid district (bernalillo county), winrock town center tid. Gross receipts by geographic area and naics code;.

Source: luciendesantis.blogspot.com

Source: luciendesantis.blogspot.com

new mexico gross receipts tax changes Neta Brannon, It varies because the total rate combines rates imposed by the state, counties, and, if applicable,. Gross receipts by geographic area and naics code;

1) Adjusting Individual Income Tax Brackets And Rates, And The Capital Gain Deduction;

Abstract this layer represents boundaries for new mexico's gross receipts tax districts as identified on the gross receipts tax rate schedule published by the.

Effective July 1, 2023, New Mexico’s House Bill 547 Expands Gross Receipts Tax (Grt) Deductions Available To Healthcare Practitioners By Allowing A New.

Identify grt location codes and rates.

The Gross Receipts Tax Rate Varies Throughout The State From 5% To 9% And Frequently Changes.

Post july 1, 2022, 5.0%.

Posted in 2024