Nc Tax Credits 2024

Nc Tax Credits 2024. Taxpayers encouraged to try innovative new option before april 15 deadline. Explore the north carolina budget.

Here’s the breakdown based on the information from. North carolina solar incentives (rebates, tax credits & more in 2024) 4in this north carolina solar incentives guide, we will answer:

North Carolina Solar Incentives (Rebates, Tax Credits &Amp; More In 2024) 4In This North Carolina Solar Incentives Guide, We Will Answer:

Federal solar investment tax credits.

Active Solar Heating And Cooling Systems.

Today, the north carolina department of revenue officially opened the 2024 individual income tax season and began accepting 2023 returns.

Welcome To The Income Tax Calculator Suite For North Carolina, Brought To You By Icalculator™ Us.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Taxpayers encouraged to try innovative new option before april 15 deadline. Active solar heating and cooling systems.

Source: rosaqlurleen.pages.dev

Source: rosaqlurleen.pages.dev

What Are The Irs Tax Brackets For 2024 Hildy Joletta, To effectively use the north carolina paycheck calculator, follow these steps: For the income earned in 2023, you can claim up to $7,430, depending on your filing status and qualifying children.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, North carolina solar incentives (rebates, tax credits & more in 2024) 4in this north carolina solar incentives guide, we will answer: What to expect when filing taxes this year

Source: ncdor-form-d-400tc.pdffiller.com

Source: ncdor-form-d-400tc.pdffiller.com

20222024 Form NC DoR D400TC Fill Online, Printable, Fillable, Blank, Andrea desantis, ph.d., will serve as the next north carolina department of commerce assistant secretary for the division of workforce solutions (dws),. The north carolina clean energy technology center (nccetc) has released an updated word to the wise resource to help residential customers become.

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, Washington — the internal revenue service. How to make the most of energy efficiency tax credits in 2024.

Source: www.youtube.com

Source: www.youtube.com

50 States in 50 Days North Carolina Tax Credits Historic, Data, Existing state law already calls for lower rates of 4.6% in 2024, 4.5% in 2025, 4.25% in 2026, and 3.99% in 2027. The bill would expand the current child tax credit, which is up to $1,600 per child, to a maximum of $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 100% of the appraised value. From solar panels to evs and insulation, there's a lot of money on the.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 80% of the appraised value. Business owners with 100 or fewer employees could get a tax credit worth 50% off the startup costs of setting up a qualified retirement plan such as a simple ira.

Source: maeqnellie.pages.dev

Source: maeqnellie.pages.dev

Federal Tax Table For 2024 Becca Carmine, To effectively use the north carolina paycheck calculator, follow these steps: Washington — the internal revenue service.

Source: www.youtube.com

Source: www.youtube.com

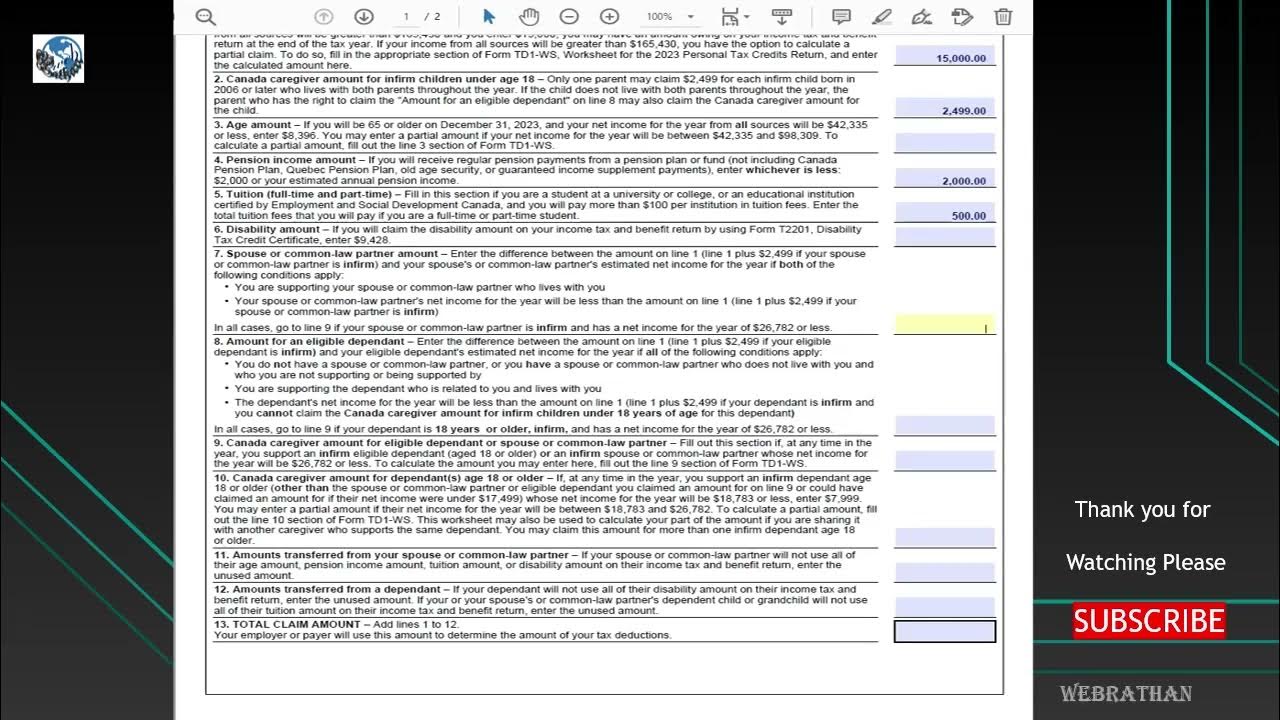

How To Fill TD1 2023 Personal Tax Credits Return Form Federal YouTube, Refundable family tax credits would make nc’s tax system. Enter your gross pay for the pay period.

As Fiscal Year 2023 Draws To A Close, North Carolina’s House And Senate Have Each Passed Their.

The north carolina clean energy technology center (nccetc) has released an updated word to the wise resource to help residential customers become.

Active Solar Heating And Cooling Systems.

Today, governor cooper joined the united states department of the treasury and internal revenue service in recognizing january 27 as earned income.